Category: Middle East / Asia

Top 10 Economies To Watch In 2024

2024 is the year of elections…for most voters, “It’s the economy, stupid” may reign supreme…these are 10 bellwether economies to watch in 2024…

Foreign Policy Re-Think Ahead of the Presidential Election Cycle: U.S. Top 5 Strategic Allies Going into 2024

Whether an internationalist or isolationist approach, there are some alliances that will be strategically vital with five countries being at the top of that list…

The Balance of ‘Enduring Partnerships’ vs. ‘Transactional Relationships’

While there are some long-standing partnerships that continue to endure through time, U.S. politicians will have to become more accustomed to the transactional nature of international diplomacy…

Saudi Arabia wants the Indian Premier League: Why Is There No Discussion of ‘Sportswashing’?

Saudi Arabia’s reported interest in the Indian Premier League has not raised any significant discussion of “sportwashing”…Why is that the case?

The Global War For Talent Is Expanding…

The tech war between countries is well-established – the U.S. and China being the least coy about this battle. There is another (more subtle) war happening…the battle for talent is quietly turning into a more global competition….

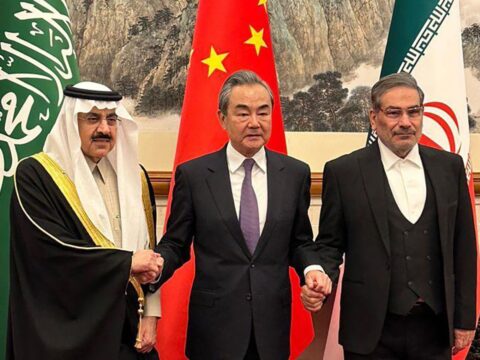

A Few Takeaways from the China brokered Saudi-Iran Deal

A China brokered Saudi-Iran deal will force the U.S. to further rethink its strategy with Saudi Arabia and the greater Middle East…

Three Inputs Often Overlooked In The Energy Transition Process

Recent legislation in the U.S. and Europe (and a war in Ukraine) is accelerating energy transition. Yet, the overhaul of policy requires significant change in other aspects of the economic system and individual livelihoods – in particular, the limited resources of metals and rare earth elements, water and land become significantly more important.

Top 10 Economies To Watch In 2023

Everyone knows economists have a poor track record of predicting recessions. Yet, it is hard to ignore the growing consensus among economists that the combination of inflation and interest rate hikes alongside tempered Chinese demand and US economic uncertainty could be the perfect storm for a global recession.

Those same economists, however, disagree on the depth and length of a potential recession as well as the underlying indicators that will answer their questions. Thus, instead of agreeing on a list of indicators, let’s focus on some countries that could be bellwethers for changing headwinds in 2023…

Qatar’s World Cup Gives Hope to Other Aspiring Countries

Qatar’s bid to host this year’s World Cup was always going to be controversial: the summers are too hot; there are not enough stadiums, hotels, and other necessary facilities; the country does not have a football culture. Still, the question of money and its influence in football should not overshadow the globalization of the sport. This World Cup is likely the prologue to more star Arab football players and maybe another Arab country hosting it…