Tag: Tax

The US Has A Budgeting Problem…Not Exactly A Debt Ceiling Issue

The U.S. Congress should consider switching from a federal debt ceiling as a nominal value to one fixed as a percentage of GDP. This debt ceiling should, on the one hand, be high enough that the government cannot reasonably cross it, but punitive enough that it disincentivizes profligate spending. This will save the U.S. from the annual political theater that occurs around debt ceiling talks and focus the discussion on the federal budget (and potentially taking revenue and spending decisions to actually control the deficit)…

The Fed, Investment Firms, And Rising Interest Rates

There are some simple life lessons in business: It is hard to be liked by all people and it is hard to be liked all the time. Leaders at central banks and investment firms know this very well… today’s economic crisis will likely end with a simple reminder of these lessons…

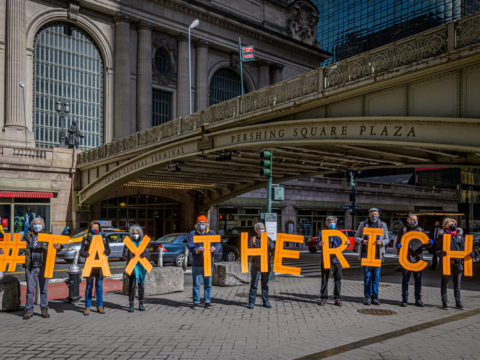

Tax Policy Is Never So Simple

The focus of tax policy should be to create the ‘necessary’ revenue mixed with a manageable level of debt to cover the requisite spending for the country. That tax revenue will involve a balance between capital, labor, and consumption taxes. Mix in the targeted investment incentives and managed spending (better said than done) and maybe you can find a solution…

Five Things To Watch As The U.S. Economy Recovers

U.S. GDP has reached its pre-covid 19 level…should we be celebrating? The answer is yes. But the economy continues to provide mix signals to the market. And, as it continues to recover, there are five things to watch…

South Africa’s taxman goes global

South Africa has long faced the reality of ‘flight’ by citizens to other countries for a myriad of reasons, including lack of economic opportunity and the prevalence of crime…