Tag: China

The Balance of ‘Enduring Partnerships’ vs. ‘Transactional Relationships’

While there are some long-standing partnerships that continue to endure through time, U.S. politicians will have to become more accustomed to the transactional nature of international diplomacy…

The Global War For Talent Is Expanding…

The tech war between countries is well-established – the U.S. and China being the least coy about this battle. There is another (more subtle) war happening…the battle for talent is quietly turning into a more global competition….

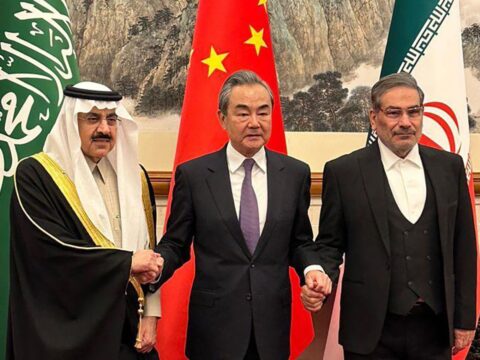

A Few Takeaways from the China brokered Saudi-Iran Deal

A China brokered Saudi-Iran deal will force the U.S. to further rethink its strategy with Saudi Arabia and the greater Middle East…

Three Inputs Often Overlooked In The Energy Transition Process

Recent legislation in the U.S. and Europe (and a war in Ukraine) is accelerating energy transition. Yet, the overhaul of policy requires significant change in other aspects of the economic system and individual livelihoods – in particular, the limited resources of metals and rare earth elements, water and land become significantly more important.

Top 10 Economies To Watch In 2023

Everyone knows economists have a poor track record of predicting recessions. Yet, it is hard to ignore the growing consensus among economists that the combination of inflation and interest rate hikes alongside tempered Chinese demand and US economic uncertainty could be the perfect storm for a global recession.

Those same economists, however, disagree on the depth and length of a potential recession as well as the underlying indicators that will answer their questions. Thus, instead of agreeing on a list of indicators, let’s focus on some countries that could be bellwethers for changing headwinds in 2023…

Why Is Saudi Arabia Reducing Its Oil Production?

Why did the Saudi authorities reduce production, despite receiving US advice to the contrary?

Lessons From Zambia’s Debt Restructuring

President Hakainde Hichilema is creating a new playbook for African restructurings…

Turning U.S. Attention from Middle East to China and Asia

The current dynamics in the Middle East are creating an opportune time for U.S. leadership to strategically shift priorities on the global stage, especially as the U.S. is not entangled in any war…

The U.S. and Saudi Arabia: A Rendezvous in the Desert…

U.S. President Joe Biden and Saudi Crown Prince Mohammed bin Salman must come together for a long awaited rendezvous in the desert…ideally the two leaders can employ some modern rules of dating in making the alliance work…