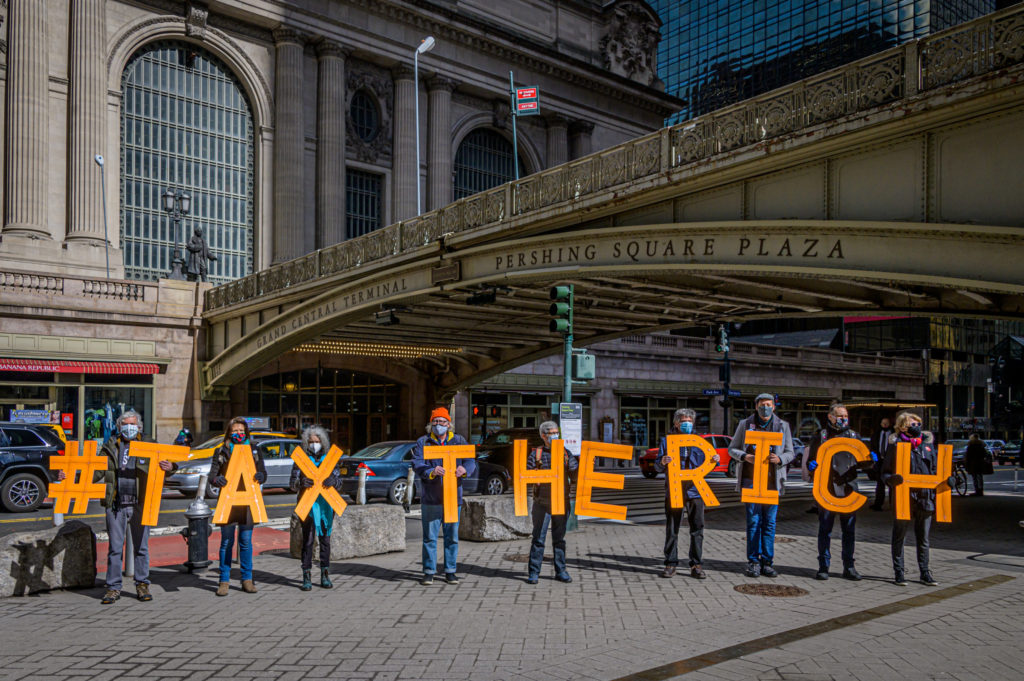

(Photo Credit: Erik McGregor/LightRocket via Getty Images)

Taxing wages, capital, and…consumption?

The U.S. is facing a debt problem…nothing new. While the timing of a fiscal cliff remains a political debate, the reality of a debt problem is not being questioned (but rather the strategy to escape it).

The imbalance between projected federal tax revenue and projected federal spending highlights the problem. The U.S. deficit is estimated to hit $3 trillion in 2021, according to the Congressional Budget Office (CBO), with the total national debt increasing to $35 trillion by 2031 compared to $23 trillion this year.

The covid-19 pandemic created an extra fiscal burden for the federal government. Unemployment insurance benefits, including the $300 top-up payments approved last January and other covid-19 relief payments, are perfect examples of those additional federal costs.

Taxing To Pay The Bill

Unable to tax wages more in this political environment, President Joe Biden’s proposed tax plan will focus on big business, the rich, and Wall Street. The Biden plan imagines a corporate tax rate of 28% (up from the current 21%), underwritten by a global corporate minimum tax of 15% (as agreed by the G7 countries).

For Americans earning more than $1 million per year, the plan would align the capital gains tax with the top rate for wage income, which the plan would bump up to 39.6%. The overall effect would be doubling the tax on capital income (from 20% to 39.6%) for rich investors, who are a large percent of corporate shareholders.

Simplistic Critiques and Unintended Consequences

The natural critiques, from Wall Street to Silicon Valley, are tax hikes, especially amid an ongoing pandemic, will short-circuit an economic recovery and ultimately kill economic growth. That response is too simple. The tax hikes will have some consequences on the economy. Those consequences, however, may be more unintended than imagined.

First, taxing savings and investment income can feel unfair. Those who earn today and spend today only pay income taxes and consumption taxes while those who defer gratification today for future gains pay additional taxes. Put that way, the spenders win, and the savers lose…discouraging saving and investment undercuts any economy in the long run. Thus, some Biden critics argue that tax plan will reduce the size of the American economy in the long run, as compared to the current projection.

Secondly, the Biden tax plan could placate the political concern of tax avoidance. Taxing capital gains at a lower rate than wage income incentivizes efforts to mask wages as capital income – this tax dance is a favorite for the wealthy. For example, the “carried interest” loophole permits hedge fund and private equity managers to categorize their fees as capital gains rather than wage income. Most consultant firms, law firms, and doctor offices utilize ‘pass through’ structures to reclassify significant income within such partnership structures as dividends and capital gains.

Tax Policy and Its Many Levers

Tax policymaking cannot be simplified to an exercise of combatting inefficiency and tax avoidance. The conversation also should not be limited to a binary debate on parity between taxing capital and labor.

Taxes are cumulative. Before companies return profits to shareholders, they pay corporate taxes…then those investors pay taxes on their return on investment. Investors can do the math…state taxes, as an example, can drive certain investors to change tax residency from New York to Florida or Texas to avoid the higher tax bill.

Consumption Taxes

Policy considerations should be given to consumption taxes and investment incentives. Critics will argue that consumption taxes are regressive in nature with the poor bearing a greater tax burden on their income than the rich – though the current tax system already has its consumption tax elements, i.e. sales taxes, excise taxes, and some forms of property taxes.

The history of the U.S. tax system, to be fair, suggests that policymakers do not miss an opportunity to add a new tax instead of re-fitting current taxes for today’s market. That would be the concern with an increased policy focus on consumption taxes, but income taxes have proved tough to administratively oversee let alone increase without the necessary political support.

A weak criticism could be that consumption taxes can become paternalistic. Taxpayer behavior is already influenced by certain tax rules. For example, ‘sin’ taxes help to curb cigarette smoking and alcohol use and create additional tax revenue. Charitable deductions and interest deductions incentivize nonprofit donations and house purchasing. On a positive note, consumption taxes could theoretically help to reduce consumption in such areas such as health care and energy.

Re-Distribution of Wealth and Income

Some policymakers will emphasize the redistributive nature of the American tax system – the combined system of consumption and income taxes can maintain progressive elements through a moderated (i.e, lower than today) income tax that is still progressive with more aggressive consumption taxes. Federal spending then can increasingly target progressive spending and outcomes. The focus of the ‘progressive’ spending could change with political parties. But that is already the reality of today’s politics and the federal budgeting process.

The ultimate concern should be to create the ‘necessary’ revenue mixed with a manageable level of debt to cover the requisite spending for the country. That revenue collection will involve finding a balance between capital, labor, and consumption taxes. Mix in the targeted investment incentives and managed spending (better said than done) and maybe you can find a solution.

This sadly is the same tax reform discussion that comes up with each new president with the main agreement between Democrats and Republicans being Americans are not fond of tax hikes thus the U.S. borrows and spends too much relative to the tax revenue it collects – again that is the problem and not the solution.